As businesses continue to rely on cloud computing and outsourcing critical services, there has been a growing need for third-party assurance regarding the security and availability of these services.

Two common methods of providing this assurance are SOC1 and SOC2 audits.

Although these audits share similarities, they have different objectives and focus areas. This comprehensive guide will explore the difference between SOC 1 And SOC 2 audits, their scope and objectives, and the benefits they offer to businesses and their customers.

By the end of this guide, you will clearly understand the key differences between SOC 1 and SOC 2 audits and how to determine which audit is most appropriate for their organization.

Table of Contents

Understanding SOC 1 and SOC 2 Audits

Before understanding the difference between SOC 1 and SOC 2 audits, you must be well-versed in these SOC audits.

So, what are SOC1 and SOC2 Audits?

SOC 1 and SOC 2 audits are necessary assessments organizations can undergo to demonstrate their commitment to security, compliance, and trustworthiness.

Third-party auditors perform these audits and assure customers, stakeholders, and partners that the organization has adequate controls to safeguard sensitive information.

SOC 1 audits, also known as SSAE 18 audits, evaluate the internal controls of service providers that process financial transactions for clients.

This audit focuses on financial reporting controls, including the design and effectiveness of controls over financial reporting.

SOC 1 audits are critical for organizations that provide financial services, such as banks, credit unions, and insurance companies, to ensure they meet regulatory compliance standards.

On the other hand, SOC 2 audits assess the effectiveness of an organization’s controls that relate to security, availability, processing integrity, confidentiality, and privacy.

The audit is based on the Trust Services Criteria, a standard developed by the American Institute of Certified Public Accountants (AICPA). SOC 2 audits are essential for organizations that store, process or transmit sensitive data, such as healthcare providers, SaaS companies, and online retailers.

The SOC 2 audit report includes a description of the controls in place, an assessment of their effectiveness, and any identified weaknesses or gaps in the controls. The report also includes a detailed description of the auditor’s testing procedures and findings.

Organizations can use the SOC 2 report to assure customers, partners, and other stakeholders that their data is protected and that they are committed to maintaining a strong security posture.

Key Difference between SOC 1 And SOC 2 Audits

SOC 1 and SOC 2 audits are two distinct types of audits that assess different types of controls within an organization.

Here are some differences between SOC1 and SOC2 audits:

Scope: SOC 1 audits focus on controls over financial reporting, while SOC 2 audits focus on controls related to security, availability, processing integrity, confidentiality, and privacy.

Purpose: SOC 1 audits are intended to ensure the financial reporting of service providers. SOC 2 audits are intended to assure the security, availability, processing integrity, confidentiality, and privacy of an organization’s systems and data.

Reporting: SOC 1 audits result in a SOC 1 report, while SOC 2 audits result in a SOC 2 report. The SOC 1 report focuses on controls over financial reporting and is intended for users of financial statements. The SOC 2 report focuses on controls related to the Trust Services Criteria.

Framework: SOC 1 audits are based on the Statement on Standards for Attestation Engagements (SSAE) 18 standard. In contrast, SOC 2 audits are based on the Trust Services Criteria developed by the American Institute of Certified Public Accountants (AICPA).

Type of Service: SOC 1 audits are typically performed for service organizations that provide financial transaction processing services, such as banks and payment processors. SOC 2 audits are typically performed for service organizations that store, process or transmit sensitive data, such as cloud service providers, SaaS companies, and healthcare providers.

Scope and Focus of SOC 1 and SOC 2 Audits

SOC 1 and SOC 2 audits have different scopes and focus. Let’s take a closer look at each type of audit:

SOC 1 Audit Scope and Focus

After understanding the difference between SOC1 and SOC2 audits, the scope of a SOC 1 audit is the internal controls over the financial reporting of a service organization.

The focus of a SOC 1 audit is on the financial transactions and related controls that impact the financial statements of the service organization’s customers.

A SOC 1 audit is typically performed for service organizations that provide financial transaction processing services, such as banks, credit unions, and payment processors.

The audit evaluates whether the controls in place at the service organization are designed and operating effectively to meet its customers’ needs and comply with relevant regulations.

The SOC 1 audit report provides an independent auditor’s opinion on the fairness of the service organization’s presentation of its controls over financial reporting.

The service organization’s customers can use the report to gain confidence in the reliability of the service organization’s financial reporting.

SOC 2 Audit Scope and Focus

The scope of a SOC 2 audit is the controls related to security, availability, processing integrity, confidentiality, and privacy of a service organization’s systems and data.

The focus of a SOC 2 audit is on the controls that the service organization has in place to protect its systems and data and meet the Trust Services Criteria established by the American Institute of Certified Public Accountants (AICPA).

A SOC 2 audit is typically performed for service organizations that store, process or transmit sensitive data, such as cloud service providers, SaaS companies, and healthcare providers.

The audit evaluates whether the controls in place at the service organization are designed and operating effectively to meet the Trust Services Criteria.

Controls Assessed in SOC 1 vs. SOC 2 Audits

The controls assessed in SOC 1 and SOC 2 audits differ due to the varying scopes and focuses. Here’s a closer look at the controls assessed in each type of audit:

Controls Assessed in SOC 1 Audit

The controls assessed in a SOC 1 audit are those related to financial reporting, including controls over the initiation, authorization, processing, recording, and reporting of financial transactions.

Examples of controls assessed in a SOC 1 audit include controls over accounts payable and receivable, payroll processing, financial statement preparation and review, and fraud prevention and detection.

The SOC 1 audit evaluates these financial reporting controls’ design and operating effectiveness at a service organization.

The auditor provides an opinion on whether the controls are suitably designed and whether they are operating effectively to meet the needs of the service organization’s customers.

Controls Assessed in SOC 2 Audit

The controls assessed in a SOC 2 audit are those related to the Trust Services Criteria established by the AICPA. These criteria include controls related to security, availability, processing integrity, confidentiality, and privacy.

Examples of controls assessed in a SOC 2 audit include access controls, encryption, backup and recovery procedures, change management, and incident response.

The SOC 2 audit evaluates these controls’ design and operating effectiveness at a service organization.

The auditor provides an opinion on whether the controls are suitably designed and operating effectively to meet the Trust Services Criteria.

How SOC 1 and SOC 2 Audit Reports are Structured and Presented?

The structure and presentation of the two SOC audit reports are similar in some ways, but there are also key differences.

SOC 1 Audit Report Structure and Presentation

The SOC 1 audit report is structured around the service organization’s description of its system and the controls in place over financial reporting.

The report includes an introductory section, a description of the service organization’s system, a section on the controls in place, the auditor’s opinion, and any additional information required by the auditing standards.

The auditor’s opinion is typically presented as a separate section. It includes a statement on the fairness of presenting the controls over financial reporting in the service organization’s description of its system.

The SOC report is typically presented in a standardized format known as the Statement on Standards for Attestation Engagements (SSAE) 18. This format provides consistency and clarity for service organization customers and other stakeholders.

SOC 2 Audit Report Structure and Presentation

The SOC 2 audit report is structured around the Trust Services Criteria and the controls in place at the service organization to meet those criteria.

The report includes an introductory section, a description of the service organization’s system, a section on the controls in place to meet the Trust Services Criteria, the auditor’s opinion, and any additional information required by the auditing standards.

The auditor’s opinion is typically presented as a separate section and includes a statement on the effectiveness of the controls in place to meet the Trust Services Criteria.

The SOC 2 audit report is typically presented in a standardized format known as the AICPA Trust Services Criteria format. This format provides consistency and clarity for service organization customers, partners, and other stakeholders.

Ensuring Ongoing SOC Compliance

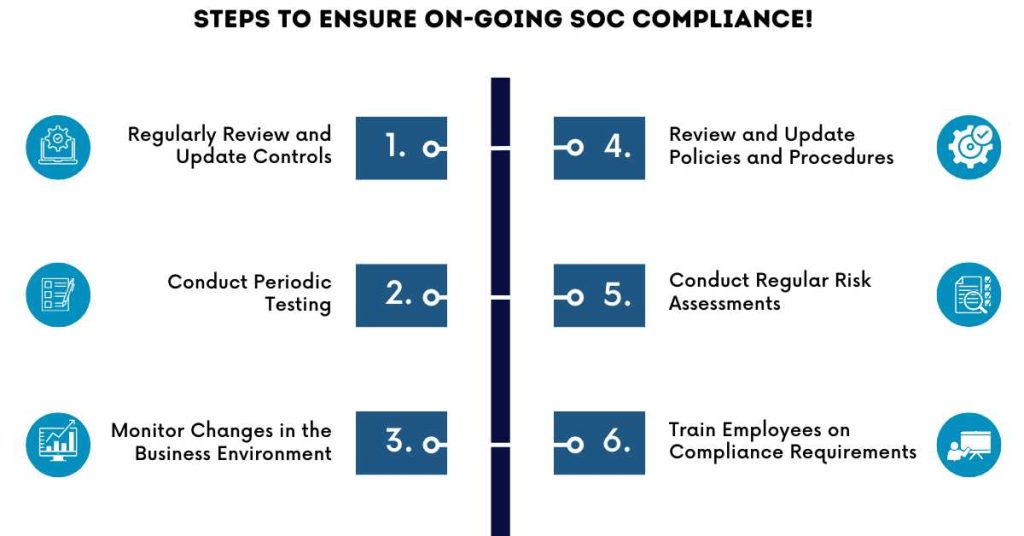

Ensuring ongoing SOC compliance is critical for service organizations to maintain their customers’ and stakeholders’ trust and confidence.

Here are some steps that service organizations can take to ensure ongoing SOC compliance:

1. Regularly Review and Update Controls

Service organizations should review and update their controls regularly to ensure that they remain effective and relevant. This includes assessing new risks and making changes to controls as needed.

2. Conduct Periodic Testing

Service organizations should periodically test their controls to ensure they operate effectively. This includes both testing of design effectiveness and testing of operating effectiveness.

3. Monitor Changes in the Business Environment

Service organizations should monitor changes in the business environment that may impact their controls. For example, changes in the regulatory environment or the technology landscape may require control changes.

4. Review and Update Policies and Procedures

Service organizations should regularly review and update their policies and procedures to reflect current best practices and meet regulatory requirements.

5. Conduct Regular Risk Assessments

Service organizations should conduct regular risk assessments to identify new risks and ensure that controls are in place to address them.

6. Train Employees on Compliance Requirements

Service organizations should train employees on compliance requirements and the importance of SOC compliance. This includes training on the policies and procedures in place and the roles and responsibilities of each employee in maintaining SOC compliance.

Conclusion

In conclusion, SOC 1 and SOC 2 audits are important for service organizations to demonstrate their commitment to security, availability, processing integrity, confidentiality, and privacy.

While both audits involve the assessment of controls, there are key differences between SOC 1 and SOC 2 audits regarding their scope, focus, and the types of controls assessed.

SOC 1 audits focus on financial reporting controls, while SOC 2 audits assess controls related to the Trust Services Criteria.

Understanding the difference between SOC1 and SOC2 audits is critical for service organizations to ensure they meet the compliance requirements of their customers and stakeholders.

By implementing the appropriate controls and processes and conducting regular audits, service organizations can maintain SOC compliance and their customers’ and stakeholders’ trust and confidence.

FAQs

What is the main difference between SOC 1 and SOC 2 audits?

The main difference between SOC1 and SOC2 audits is that SOC 1 audits are focused on controls related to financial reporting, while SOC 2 audits assess controls related to security, availability, processing integrity, confidentiality, and privacy.

Are SOC 1 and SOC 2 audits interchangeable?

No, SOC 1 and SOC 2 audits are not interchangeable. They assess different types of controls and serve different purposes.

Which type of audit is best for my organization?

The choice between SOC 1 and SOC 2 audits depends on the nature of your business and the types of controls that are most important for your customers and stakeholders.

What are the Trust Services Criteria?

The Trust Services Criteria are principles and criteria developed by the American Institute of Certified Public Accountants (AICPA) to assess security, availability, processing integrity, confidentiality, and privacy controls in SOC 2 audits.

What is the difference between a Type 1 and Type 2 audit?

A Type 1 audit assesses the design effectiveness of controls, while a Type 2 audit assesses both the design and operating effectiveness of controls over a period of time.

Can a service organization be SOC 1 and SOC 2 compliant simultaneously?

Yes, a service organization can simultaneously be SOC 1 and SOC 2 compliant if they have implemented the appropriate controls and processes to meet the compliance requirements of both audits.

Do SOC 1 and SOC 2 audits have different reporting requirements?

Yes, SOC 1 and SOC 2 audits have different reporting requirements based on the scope and focus of the audit. The reporting requirements for SOC 1 audits are outlined in Statement on Standards for Attestation Engagements (SSAE) 18. In contrast, the reporting requirements for SOC 2 audits are outlined in the AICPA Trust Services Criteria.

What is the cost of a SOC 1 or SOC 2 audit?

The frequency of SOC 1 and SOC 2 audits depends on the nature of the business and the requirements of customers and stakeholders. Generally, SOC 1 audits are conducted annually, while SOC 2 audits may be conducted less frequently based on customer demand.